CHECKING & SAVINGS

Banking that grows with you

Free checking and savings, virtual cards, and powerful business tools—no traditional limitations.

CHECKING & SAVINGS

Banking that grows with you

Free checking and savings, virtual cards, and powerful business tools—no traditional limitations.

CHECKING & SAVINGS

Banking that grows with you

Free checking and savings, virtual cards, and powerful business tools—no traditional limitations.

No-fee checking & savings

No-fee checking & savings

FDIC-insured via partner banks and sweep programs

Support cards, ACH, crypto, links, and embedded widgets—online or in person, globally

Card issuance

Card issuance

Virtual and physical debit and credit cards

Bring your own acquirers or use Ozura-issued MIDs for full flexibility without provider lock-in

No-cost wires

No-cost wires

Send domestic and international USD wires for free

Operate with PCI-certified security and unlock richer analytics through immutable Digital Asset Receipt (DAR)

Accounting sync

Accounting sync

Automatically categorize transactions and sync with QuickBooks, Xero, or NetSuite

Support cards, ACH, crypto, links, and embedded widgets—online or in person, globally

Invoices

Invoices

Collect customer payments directly into your business account

Bring your own acquirers or use Ozura-issued MIDs for full flexibility without provider lock-in

Flexible yield accounts

Flexible yield accounts

Grow cash balances while keeping funds available when you need them

Operate with PCI-certified security and unlock richer analytics through immutable Digital Asset Receipt (DAR)

Zero-setup selling

Payments without the overhead

Collect payments online without running a site, supporting an app, or deploying POS devices

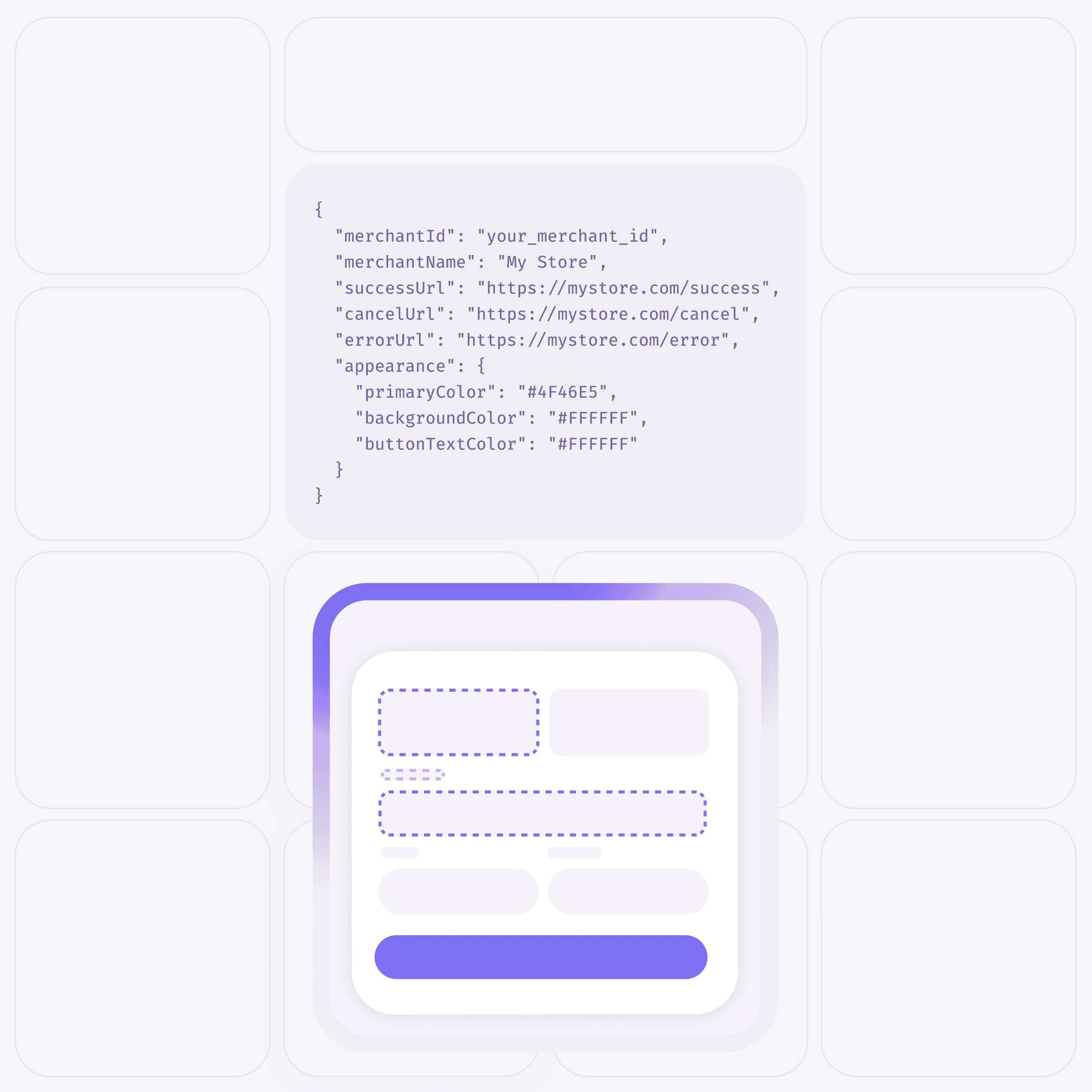

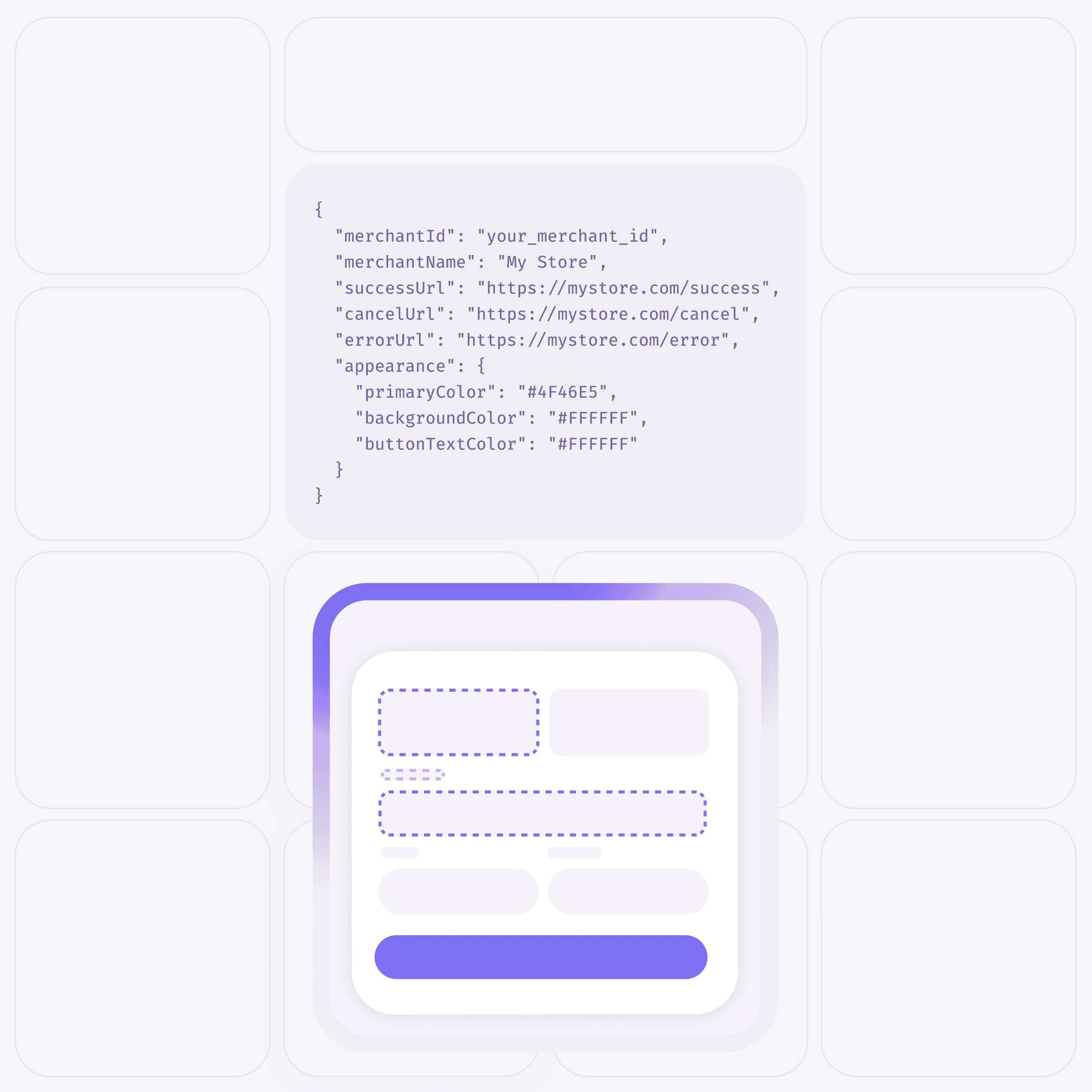

CUSTOM UI

Checkout, your way

Create a checkout experience that looks and behaves like it belongs.

Contact sales

Let's collect a few details about your business before we get you started.

Have more questions? Contact our support team with any questions you may have.

What is OzuraPay?

OzuraPay is a modular financial infrastructure platform that unifies payments, banking, orchestration, and settlement into a single system.

Can I use my existing acquirers or MIDs?

Yes. OzuraPay is provider-agnostic, allowing you to connect existing acquirers or use Ozura-issued accounts without lock-in.

How does OzuraPay handle compliance and security?

OzuraPay abstracts compliance with built-in PCI vaulting, 3DS, fraud tools, and secure tokenization—so you can build without regulatory overhead.

Who is OzuraPay built for?

OzuraPay is built for ISOs, merchants, and fintechs that need flexible, scalable payment and banking infrastructure.

How does OzuraPay help businesses scale?

OzuraPay enables multi-provider routing, redundancy, and unified reporting through a single ledger—so you can scale without re-platforming.

What is OzuraPay?

OzuraPay is a modular financial infrastructure platform that unifies payments, banking, orchestration, and settlement into a single system.

Can I use my existing acquirers or MIDs?

Yes. OzuraPay is provider-agnostic, allowing you to connect existing acquirers or use Ozura-issued accounts without lock-in.

How does OzuraPay handle compliance and security?

OzuraPay abstracts compliance with built-in PCI vaulting, 3DS, fraud tools, and secure tokenization—so you can build without regulatory overhead.

Who is OzuraPay built for?

OzuraPay is built for ISOs, merchants, and fintechs that need flexible, scalable payment and banking infrastructure.

How does OzuraPay help businesses scale?

OzuraPay enables multi-provider routing, redundancy, and unified reporting through a single ledger—so you can scale without re-platforming.

What is OzuraPay?

OzuraPay is a modular financial infrastructure platform that unifies payments, banking, orchestration, and settlement into a single system.

Can I use my existing acquirers or MIDs?

Yes. OzuraPay is provider-agnostic, allowing you to connect existing acquirers or use Ozura-issued accounts without lock-in.

How does OzuraPay handle compliance and security?

OzuraPay abstracts compliance with built-in PCI vaulting, 3DS, fraud tools, and secure tokenization—so you can build without regulatory overhead.

Who is OzuraPay built for?

OzuraPay is built for ISOs, merchants, and fintechs that need flexible, scalable payment and banking infrastructure.

How does OzuraPay help businesses scale?

OzuraPay enables multi-provider routing, redundancy, and unified reporting through a single ledger—so you can scale without re-platforming.