FLEXIBLE FINANCING

Capital that scales with you

Access funding to invest in inventory, ads, and growth as your business expands.

FLEXIBLE FINANCING

Capital that scales with you

Access funding to invest in inventory, ads, and growth as your business expands.

FLEXIBLE FINANCING

Capital that scales with you

Access funding to invest in inventory, ads, and growth as your business expands.

Funding built for growth

Funding built for growth

Working capital designed to support expansion, not limit it

Support cards, ACH, crypto, links, and embedded widgets—online or in person, globally

Predictable repayment

Predictable repayment

Fixed weekly payments with no revenue-based variability

Bring your own acquirers or use Ozura-issued MIDs for full flexibility without provider lock-in

Capital without constraints

Capital without constraints

Use funds freely, with no personal guarantee or prepayment penalties

Operate with PCI-certified security and unlock richer analytics through immutable Digital Asset Receipt (DAR)

REAL-TIME LENDING

Smarter underwriting, better terms

By underwriting across every sales platform, we structure financing based on how your business actually earns.

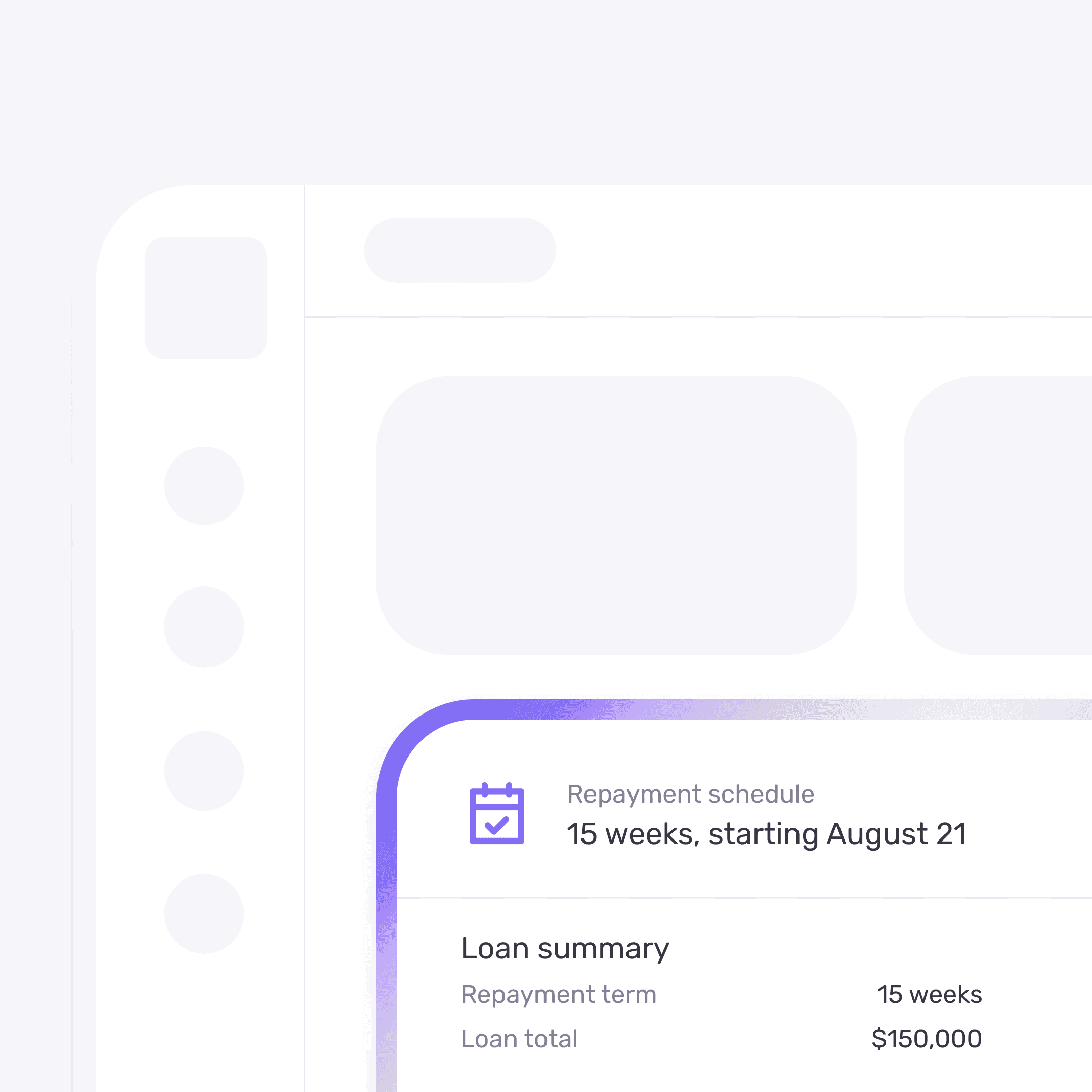

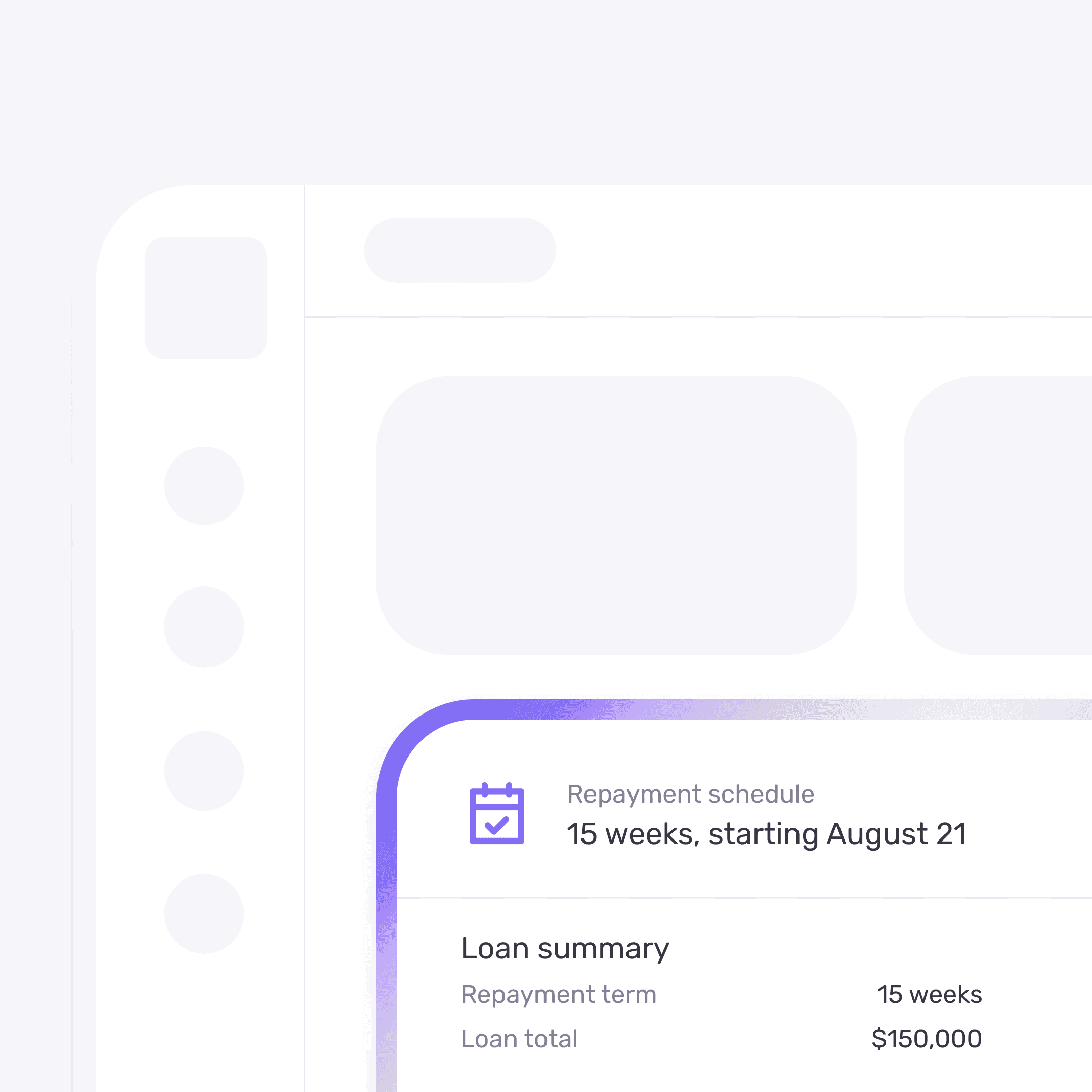

Terms & timeline

Clear terms, fixed payments

A fixed repayment schedule gives you full visibility into your loan costs over time

Contact sales

Let's collect a few details about your business before we get you started.

Have more questions? Contact our support team with any questions you may have.

What is OzuraPay?

OzuraPay is a modular financial infrastructure platform that unifies payments, banking, orchestration, and settlement into a single system.

Can I use my existing acquirers or MIDs?

Yes. OzuraPay is provider-agnostic, allowing you to connect existing acquirers or use Ozura-issued accounts without lock-in.

How does OzuraPay handle compliance and security?

OzuraPay abstracts compliance with built-in PCI vaulting, 3DS, fraud tools, and secure tokenization—so you can build without regulatory overhead.

Who is OzuraPay built for?

OzuraPay is built for ISOs, merchants, and fintechs that need flexible, scalable payment and banking infrastructure.

How does OzuraPay help businesses scale?

OzuraPay enables multi-provider routing, redundancy, and unified reporting through a single ledger—so you can scale without re-platforming.

What is OzuraPay?

OzuraPay is a modular financial infrastructure platform that unifies payments, banking, orchestration, and settlement into a single system.

Can I use my existing acquirers or MIDs?

Yes. OzuraPay is provider-agnostic, allowing you to connect existing acquirers or use Ozura-issued accounts without lock-in.

How does OzuraPay handle compliance and security?

OzuraPay abstracts compliance with built-in PCI vaulting, 3DS, fraud tools, and secure tokenization—so you can build without regulatory overhead.

Who is OzuraPay built for?

OzuraPay is built for ISOs, merchants, and fintechs that need flexible, scalable payment and banking infrastructure.

How does OzuraPay help businesses scale?

OzuraPay enables multi-provider routing, redundancy, and unified reporting through a single ledger—so you can scale without re-platforming.

What is OzuraPay?

OzuraPay is a modular financial infrastructure platform that unifies payments, banking, orchestration, and settlement into a single system.

Can I use my existing acquirers or MIDs?

Yes. OzuraPay is provider-agnostic, allowing you to connect existing acquirers or use Ozura-issued accounts without lock-in.

How does OzuraPay handle compliance and security?

OzuraPay abstracts compliance with built-in PCI vaulting, 3DS, fraud tools, and secure tokenization—so you can build without regulatory overhead.

Who is OzuraPay built for?

OzuraPay is built for ISOs, merchants, and fintechs that need flexible, scalable payment and banking infrastructure.

How does OzuraPay help businesses scale?

OzuraPay enables multi-provider routing, redundancy, and unified reporting through a single ledger—so you can scale without re-platforming.